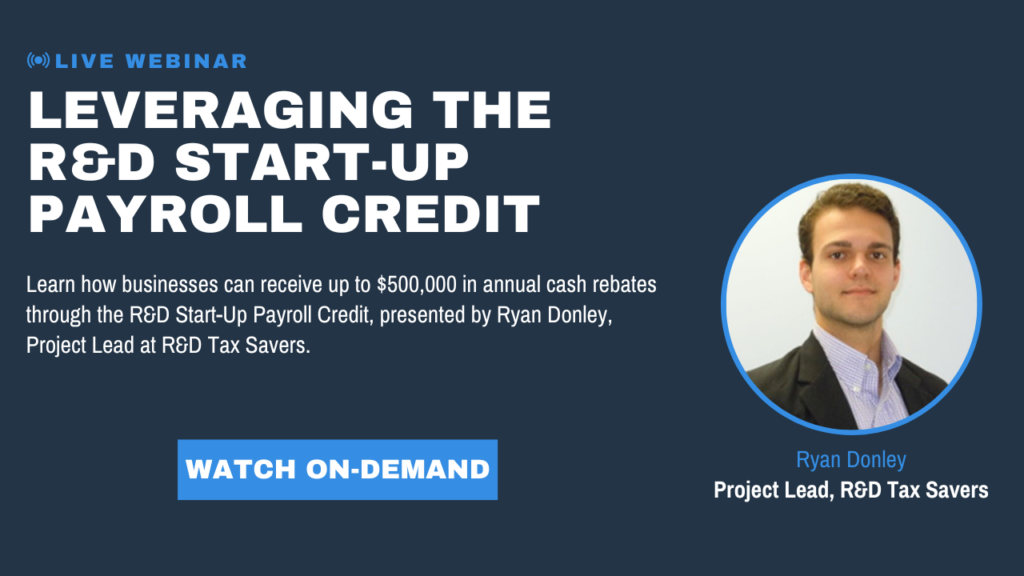

Discover how NYC start-ups can benefit from a cash rebate of up to $500,000 per year through the start-up payroll program.

You’ll learn:

- What is the Start-Up Payroll Credit? Gain an understanding of this credit and how it works.

- Benefits for Your Company. Learn why applying for this credit can be advantageous for your start-up.

- Credit Calculation Methods. Discover how the payroll tax credit amount is calculated, including the potential for a cash rebate of up to $500,000 per year.

- Getting Started. Find out the steps to take to determine eligibility and how to receive a complementary analysis and estimate.

- Case Studies. Explore specific examples of how manufacturers in NYC have utilized this credit.